- Money Convos with Steph & Den

- Posts

- Is $1 Million Enough To Retire? 👀

Is $1 Million Enough To Retire? 👀

Happy Sunday, and happy February 1st!

The shortest month of the year is here, but we don’t have a short issue of Money Convos for you this month - we actually have a lot to talk about. So, let’s get right into it!

Here’s what’s up in this copy 🤑🗞

Is it possible to retire with $1 million? 🤔

Steph’s goal to spend $32k or less this year 💰

Our DIY investing results 👀

We ‘combined’ our bank accounts 🫢

How to be prepared for tax season 🤓

Money Convo Of The Month

Is Retiring With $1 Million Really Enough?

We recently shared a video where we talked about how we’re on track to retire with over $1 million, and one of the main comments we received was ‘Is $1 million really enough money to retire with?’.

And you know what? That’s a fair question! We have a few thoughts.

First of all, we’re collectively on track to retire with over $1 million, but $1 million has been the benchmark figure that’s been used when talking about investing for retirement for many years now.

According to a few different studies, only about 3.2% of Americans retire with $1+ million (in investable assets specifically - we’re not talking about home equity here), and less than 10% of Canadians retire with $1+ million.

Sooo, it’s an interesting topic - on one hand, most people don’t hit that $1 million benchmark by the time they retire, but on the other hand, it seems like people (as a collective) don’t feel like $1 million will even be enough by the time they retire. Those two points definitely contradict one another.

But let’s start with really breaking down if $1 million ‘is enough to retire’.

There’s a common retirement planning guideline, or rule of thumb, when it comes to thinking about how much money you can afford to spend in retirement - it’s called The 4% Rule. The guideline works like this - if you withdraw 4% (or less) of your entire retirement portfolio balance in your first year of retirement, and then continue to do that (while adjusting the exact percentage for inflation each year), you have a high probability of not running out of money for at least 30 years.

So, let’s say you have a $1 million retirement portfolio balance when you retire - that means that you’d have ~4% of that to spend per year, which would be $40,000. So, according to this guideline, if you can live on ~$40,000/year, and you only expect to be retired for 30 years, then technically yes - $1 million would be enough to retire with.

*Note: Keep in mind that this is a very simple overview, and there is more to think about when it comes to your actual retirement withdrawal plan, beyond simply taking out 4% per year. We could go on about this topic… and we probably will in a future issue! But for now, we can use this guideline as a rough idea of what $1 million would do for you in retirement.

So, that’s that - $1 million could be ‘enough’ money in retirement… It depends on your expenses and life expectancy. You can adjust the amount of money you personally would ‘need’ based on those two factors (annual expenses + retirement length). But, many people don’t think about just having ‘enough’ in retirement… They think about having money left over for all of their wants. This creates an interesting dynamic between the concept of a specific sum of money being ‘enough’ vs being ‘ideal’.

Now, let’s get back to the elephant in the room, which is the fact that most people don’t even have $1 million saved (and/or invested!) for retirement in the first place.

One of our main goals with our personal finance content is to help change that statistic. We want as many people as possible investing 1) as early as possible, and 2) as much as possible (and ideally passively investing for the long-term specifically). It’ll help future you so much, and it’s never too late to start.

Here’s a very simple example - even if you haven't started investing at all yet, if you started investing $1,000/month for 30 years, assuming an average annual return of 8%, you could have over $1.4 million. Again, you can adjust these factors to make it more personal to you (the amount per month + the number of years).

We’re barely scratching the surface of this topic, but for now, we ideally want you to reflect on what your retirement number is (aka how much money you’d like to have before you retire), and also how you think about the idea of having $1 million in general (and what that really means to you).

If you want to hear more about this topic, check out this video.

$32,000 Or Less Challenge 💰

ICYMI, one of my main goals for 2026 is to spend $32,000 or less this year.

Every year, I track my spending, and the first time that I ever saw a dramatic increase in my annual spending was back in 2023, when I spent $37,000. After some very intentional changes the next year, I brought that amount down to $32,000. Then, last year, I took my foot off the gas a little bit, as my annual total came in at $36,000.

Now, that’s not to say that spending more money is inherently a bad thing… but, I personally know that I’m capable of having a well-balanced year while still spending only $32,000. So, that’s my personal challenge for 2026!

Here are the ‘ground rules’ -

The $32,000 is for my monthly budget specifically - I have a different savings account for travel and/or specific big expenses

My fixed expenses went up by ~$294 between 2024 and 2025, so - assuming the same increase this year - my fixed expenses should be ~$588 higher this year than the last time that I managed to spend $32,000 in one full year; with that being said, I still think I should be able to come in ‘on budget’, as it’s a fairly minor increase

This is a challenge I’m taking seriously, but it’s also ultimately just for fun - if I come in over budget, that’s okay! But ideally it will help me be even more intentional with my spending

With all of that out of the way, let’s get into my January results!

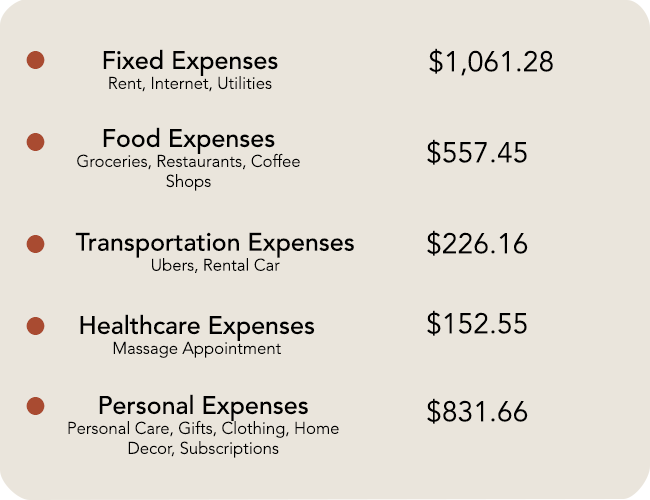

In January, I spent $2,829.10, and here’s how it was split out -

That means that I have $29,170.90 left in my annual total to spend for the next 11 months of 2026.

Now, technically I need to spend an average of $2,666.67/month to hit my goal, but that’s an average - being slightly over budget this month is okay, as long as I come in under budget some months, too!

Stay tuned for next month’s update - I’ll be taking you along for the journey throughout the year. If you want to see me talk about this in video form, check out this video.

Our Investment Portfolio Results 📈

Both of us have been DIY investing for several years now, and our investment strategies are 1) the same between the two of us and 2) pretty set in stone at the moment.

Here’s the TLDR - We use a self-directed, low fee investment platform; we invest in our tax-advantaged investment accounts first, in a specific order; we invest in two globally diversified, passive ETFs; and we invest $2,000/month each (plus any additional money we receive, from tax refunds to bonuses).

By the way, when we say that we invest in our tax-advantaged investment accounts first in a specific order, that order is our tax free account (that we use to invest for retirement), then our first home account, and then our retirement account. We only plan on investing inside of our taxable investment accounts when we max out all of our tax-advantaged accounts first.

We’ve been tracking our investment progress and results for the past ~6 years, but it’s been a full year since our last update.

So, these are Steph’s updated results…

…and these are Dennis’ updated results!

Keep in mind that these are our short-term results… but we’re long-term investors! That means that our focus is on 1) contributing as much money as possible to our investments while we’re young with flexible budgets, and 2) tracking our results to see how our work is paying off and taking advantage of compound interest over time.

With that being said, these amounts will fluctuate - going up and down on a yearly basis - but ideally they’ll trend upwards over the long-term.

If you want more details on exactly what ETFs we invest in, and want to hear even more about our investment results, check out this YouTube video and this YouTube video.

We ‘Combined’ Our Bank Accounts 🫱🏿🫲🏻

Last month, we mentioned that a big focus for us this year - now that we’re engaged - is to start really tracking our net worth as a collective household…

…and one step that we wanted to take was creating a ‘household’ on the investment platform that we both use (which we did!).

To explain that a bit more, this doesn’t actually involve us combining our bank accounts - they aren’t attached, and they aren’t joint accounts. Instead, the platform that we use simply creates a dashboard that (from a data POV) adds our account values together, to show us - live, and in one place - what our combined net worth on that specific platform is.

Now that we’ve started using this feature, we can see our individual amounts and our combined amounts (and it breaks down our combined amounts by account type - so, we can see how much money we collectively have invested vs saved).

You know that we have a big collective net worth goal this year, so having our combined amounts visible at the top of our investment platform dashboard is perfect.

If you want to see what this actually looks like, check out this video.

Tax Season Tips 💡

Tax season is coming up soon, and it’s important that you’re prepared and ready!

So many people try to avoid the inevitable… but we promise that tax season doesn’t have to be anxiety inducing. It’s all about having a plan and being organized, and we can help with that.

Here’s what you need to know -

Add key tax filing dates to your calendar: What’s the tax filing deadline where you live? (Aka in Canada it’s April 30th, 2026, and in the United States it’s April 15th, 2026).

Pick a day to file your taxes before the deadline: Now that you know the deadline, pick a date well before that day to actually sit down and file your taxes, so you aren’t stressing out at the last minute.

Decide how you’re going to actually file your taxes: For example, if you’re going to be doing it yourself, figure out what platform you’ll be using.

Compile all of your important tax information: Gather everything that you might need, like your 2025 taxable income (from your salary, from your investments, etc), your tax slips and documents, and any updated personal information (like your address if it’s changed, marital status if it’s changed, etc).

Learn what’s new for the 2026 tax season: There are new tax benefits and credits every single year, so take a few minutes to look up what you might be eligible for this tax season.

And we’ll leave you with that! We hope that you have an amazing month ahead of you. ✨

P.S. You can catch up with us on Instagram and YouTube

Was this forwarded to you? Sign up here

Have a question for us? Submit it here